CFD brokers are increasing in popularity in 2020, given that extreme market conditions are pushing traders towards day trading strategies. ClickTrades is one of the brands currently ascending, they come with a very comprehensive trading offer. Operated by KW Investments Limited, which is authorized and regulated by the Seychelles Financial Services Authority (license number SD020), ClickTrades provides access to more than 2,1000 instruments via two solid trading platforms. It operates as a global provider, except for residents of certain jurisdictions, including Japan, Canada, and The United States of America.

Trading Tools

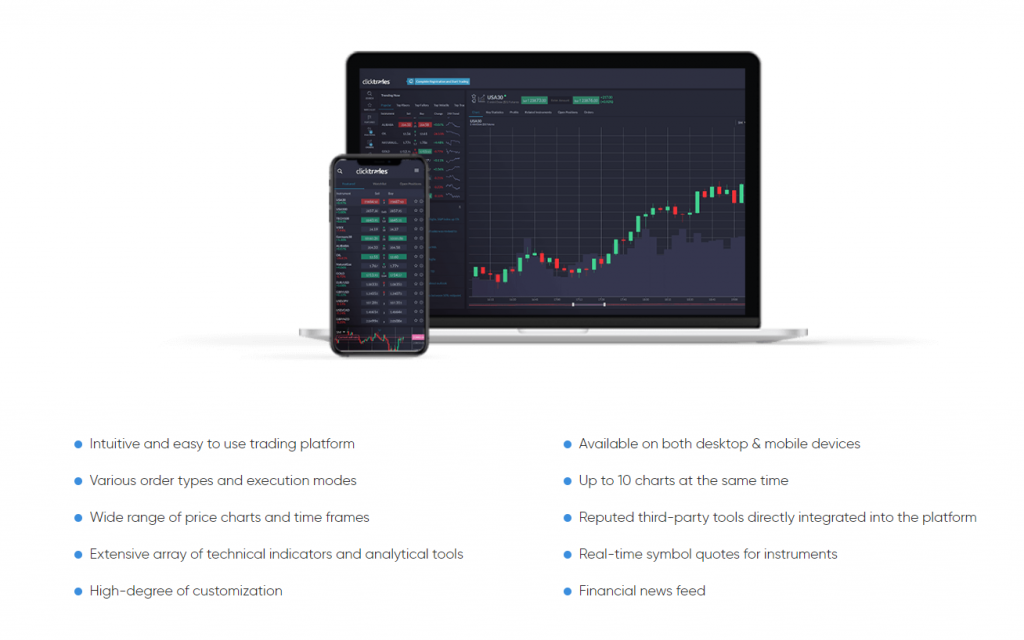

To create the optimal trading environment, ClickTrades has designed WebTrader, a proprietary software available on both desktop and mobile devices. It’s an intuitive and easy-to-use platform, integrating popular tools as well as reputed third-party features designed to provide enhanced information for customers. The platform allows up to 10 charts at the same time, and integrates a financial news feed. Additionally, for traders accustomed to MetaQuotes software, the well known MetaTrader 5 is also part of the offer. However, clients are allowed to trade 400+ assets via MT5.

In terms of trading conditions, ClickTrades offers access to 2,100 instruments, ranging from CFDs on forex, shares, indices, commodities, cryptocurrencies, bonds, and ETFs. Maximum leverage is 1:300 depending on the instruments, fixed/variable spreads, and competitive overnight swaps are some of the features to be mentioned.

Also, since commodities trading is on the rise, the broker has a competitive advantage, given that ClickTrades offer grants access to 18 different CFDs based on commodities. Gold, silver, crude oil, copper, platinum, as well as orange juice, rice, corn, and cotton had been included. Gold and oil had been some of the most popular commodities during the first quarter of 2020, given the global economic uncertainties.

At ClickTrades, clients can trade CFDs on Gold with 1:200 leverage, and CFDs on crude oil with 1:5 leverage, respectively. The economic shock produced by the coronavirus pandemic should keep commodities active throughout the year, as demand/supply imbalances will continue to linger.

Available only for Signature account holders, Trading Central is a third-party tool integrated into WebTrader. Right now, it’s one of the most popular technical analysis tools, backing trading decisions via several technical indicators. The tool is developed by a global brand that had supported investment decisions since 1999.

Account Types

Clients wanting to work with ClickTrades will need to choose between three different account types:

- Essential

- Original

- Signature

A different set of trading features had been set of each account type, with a certain minimum deposit required. As a result, Essential account holders will have access to daily market reviews & financial research, daily analyst recommendations provided by a third party, full access to a comprehensive video library, and a dedicated account manager. Features are more diverse for Original and Signature accounts, which will benefit from open access to research, special trading conditions, Trading Central, and one-to-one meetings with an account representative.

Promotions

With the main goal of providing traders with the ultimate experience, ClickTrades provides several promotions. New clients can receive up to $3,000 bonus, depending on the size of their initial deposit. Also, ClickTrades now provides access to trading with 0 commission, no matter the instruments concerned. It’s important to mention that all trading bonuses have terms and conditions attached.

ClickTrades is one of the highly praised CFD brokers managing to keep up with the needs of traders in 2020. It does so by providing some of the latest trading functionalities and a diverse trading offer, suited for all types of traders all around the world.

Risk Warning: The materials contained on this document are not made by ClickTrades but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Trading CDF’s involves significant risk of loss.

Leave Your Comments