(1888 PressRelease) 2015 ezPaycheck payroll software has updated for restaurant employers with new tax tables and forms. Please visit www.halfpricesoft.com for details and trial download.

Houston, TX – Paying employees on time and accurately should be easy for restaurant owners in Year 2015. Small business payroll software ezPaycheck 2015 rolled out to streamline payroll processing for small businesses. Priced at $89 per year, ezPaycheck payroll software is affordable for any businesses. With the new release and the end of the year upon, a limited time price reduction for ezPaycheck 2014 and 2015 bundle version is being offered for only $99.00.

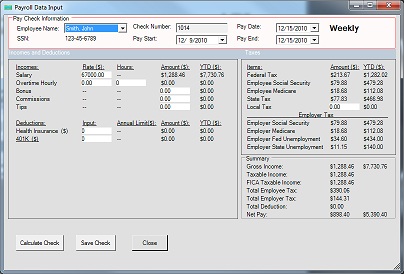

EzPaycheck program is easy and affordable payroll tax solution for the foodservice industry including restaurants, coffee stores, bakeries, bars and many more. This payroll software makes it easy to handle new employee, payout, tips and differential rate.

Included in the newest 2015 version are:

New Year 2015 Federal, State income tax tables

Latest W2, W3, 941 and 940 tax forms for coming 2015 tax season.

ezPaycheck software can handle the paychecks for both employees and contractors

ezPaycheck can handle tips in restaurants.

Growing businesses can add up to 500 employees with no extra cost.

“EzPaycheck payroll software make it easy to pay employees on time. We also launched the special 2014 & 2015 bundle version so small businesses can automate payroll tax processing during the busy holiday season and get ready for year 2015.” explains Dr. Ge, President and Founder of halfpricesoft.com

Small Businesses are always looking for ways to save money on payroll processing and tax reporting. Customers can try out this new ezPaycheck payroll solution for 30 days at http://halfpricesoft.tekplusllc.com/ezPaycheck.asp, with no obligation and risk.

The unique features include:

– New W2 print feature: EzPaycheck now print W2 forms in 4-up format

– Offers no cost live chat, email and remote access for customer support

– Supports differential pay rates within the company

– Supports daily, weekly, biweekly, semimonthly and monthly pay periods

– Features report functions, print functions, and pay stub functions

– Supports both miscellaneous checks and payroll calculation checks

– Supports both blank computer checks or preprinted checks

– Automatically calculates Federal Withholding Tax, Social Security, Medicare Tax and Employer Unemployment Taxes

– Includes built-in tax tables for all 50 states and the District of Columbia

– Creates and maintains payroll for multiple companies, and does it simultaneously

– Prints Tax Forms 940, 941, W-2 and W-3

– Supports unlimited accounts at no additional charge

– Supports network for multiple users

No small company can last for long if the owner cannot focus on core business. To learn more how to do more for less with ezPaycheck 2014 and 2015 bundle version visit http://www.halfpricesoft.com/payroll-software/restaurant-payroll-software.asp

About Halfpricesoft.com

Halfpricesoft.com is a leading provider of small business software, including payroll software, employee attendance tracking software, accounting software, check printing software, W2, software, 1099 software, and ezACH direct deposit software. Software from halfpricesoft.com is trusted by thousands of customers and will help small business owners simplify their payroll processing and business management.