One broker is offering retail traders an excellent way to access the trading markets. TRADE.com, the leading European multi-asset brokerage firm has recently started offering investors a direct link to order books of the global exchanges. This in effect strips away the middle-man, otherwise known as the market maker and allows investors to directly connect to the source of the pricing, thus giving the investor a slightly better execution price.

For example let’s say an investor wants to buy an asset that is listed on the FTSE 100, for instance BP. Rather than buy it through a middle man at a more expensive price, he can go directly to the source (the London Stock Exchange) for accurate pricing and instant execution. A company like TRADE.com effectively gives investors the doorway to get through to the order books of exchanges like the LSE.

What will he need for DMA?

He will need to work with a broker such as TRADE.com that supplies the sophisticated technology that can connect him directly to the market. There are many benefits to access the markets in this way. They include:

- Equality: Every order placed is equally important and is only prioritised based on the price offered and the time offered.

- No human error: Cutting out the middle-man or the involvement of the human means less can go wrong.

- Better pricing: Less involvement from the broker means they can pass these cost savings on to the trader.

- Speed: As the trade doesn’t need to be executed by a human, this means execution is instant, removing the chance of slippage.

- Security: The market is supervised directly by the regulated Exchange and order books are always available during market open times.

- Transparency: Everyone investing in the marketplace has full visibility of the orders and prices being placed.

- Anonymity: The participant can remain anonymous, unlike investors that are placing trades through the broker.

- Depth of order book: Investors can see the amount of buyers vs. the amount of sellers in the order book.

- Set your own price: Investors can set their own limit order, like stop loss and take profit and these are also accessible to all other market participants.

- Narrow spreads: The spreads become narrower as the whole marketplace benefits from the public display of limit orders

- Auctions: Market participants can gain access to both pre and post-market auctions where usually the best prices occur.

Trading DMA with TRADE.com?

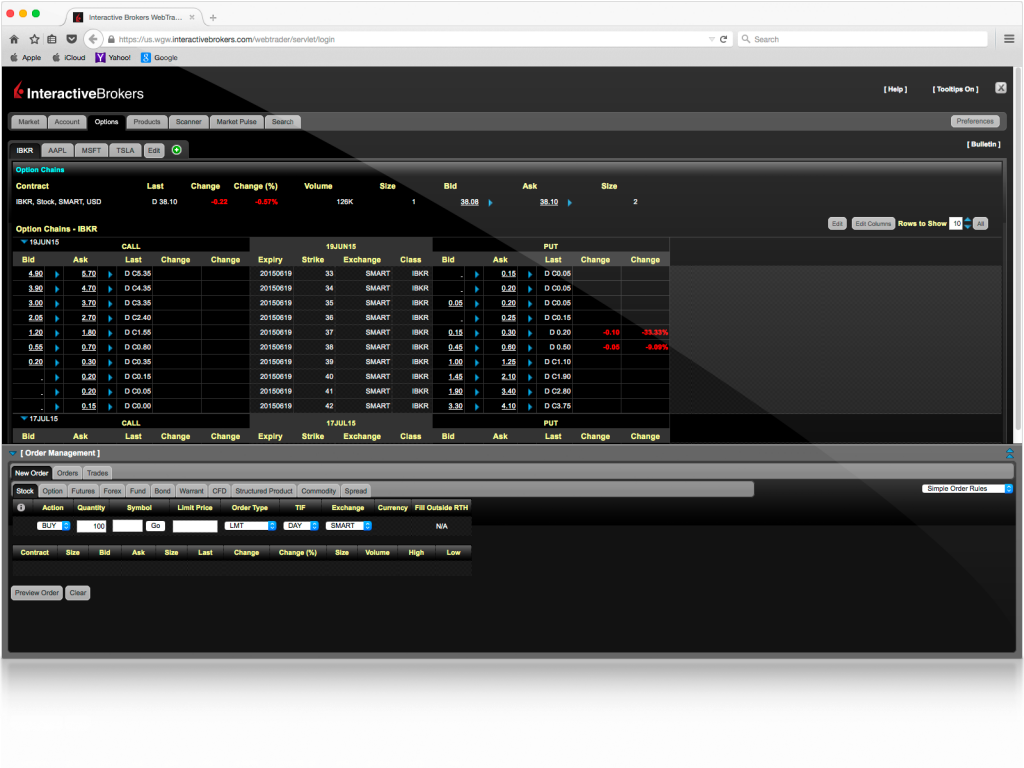

TRADE.com is a retail investment firm, offering a wide selection of markets to all kinds of investors. With regards to their DMA access, they offer access to over 120 global markets with one single account, which is free to sign up to. They give investors the ability to trade hundreds of thousands of assets which include stocks, options, futures, Forex, funds, bonds and warrants through the IBKR platform.

This sophisticated platform is powered by Interactive Brokers and contains a number of really useful features and advanced tools, yet the interface is simple enough to be understood by a less experienced investor.

The platform is a webtrader, meaning it runs through the internet, with no need for a software download. It offers traders the ability to create orders with one click or to set up more advanced orders such as pending orders. The platform allows traders to trade using preset strategies, or even to build their own custom strategies.

Other useful features:

Market Depth shows others bids and offers to allow investors to better gauge market liquidity.

BookTrader let’s investors see deep order book data for any instrument and to quickly and simply create and transmit orders.

Contract Search gives investors the opportunity to find instrument information easily.

The platform is completely customizable and can be set up to the individual’s preference.

Leave Your Comments