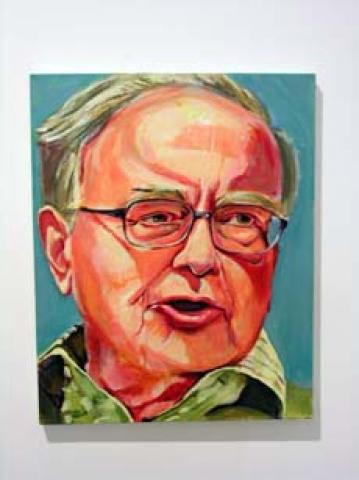

A truly amazing article by Motley Fool states that Warren Buffet, the billionaire investor cum philanthropist, rarely takes into account details while investing. Considering the Motley Fool stock advisor review here, I would venture to say they have credibility in what they say.

How can such ignorance be bliss? And worse, why admit it?

Well, the secret is his stock picks offer a value discount far greater than the average 10 % that the short-term investor is looking for. Subsequently, the details don’t matter.

Let me elaborate: For example if Pfizer has a drug in the pipeline. Is he worried that it will or will not pass the FDA’s requirements? No, don’t be a fool….or at least a Motley!

The bigger picture is Buffet goes for the big bite: long term, quality businesses that he believes in – no real hoopla in terms of technical analysis, that is.

As far as Buffet is concerned, it doesn’t matter what’s in the pipeline because what’s in the pipeline changes every five years or so for most companies. And Warren tends to hold to his stocks mighty possessively – for decades, in fact.

Leave Your Comments